FREDY BHESANIA

“Sets and steers a rigorous path to surpass business goals, extract costs and improve efficiency through innovative technology solutions”

Visualize. Believe. Attain.

Those are the pillars that have guided my career leading IT projects and program delivery in Canada, Kuwait and India. VISUALIZE the solution required. BELIEVE in the team. ATTAIN or surpass expectations. Nothing is impossible when you match the business to the right information technology solution and the right leadership approach.

CAREER PROFILE

Optimistic, challenge and performance-driven IT professional, serves as a conduit and instigator of action between multiple stakeholders, rallying and inspiring diverse teams to meet pressing demands. Persistent, rattles the status quo, keeps a steady keel removing hindrances to advance the business and fortify the competitive edge. Transactional and empowering thought leader, ignites enthusiasm, encourages career and personal development. Active communicator, simplifies technical jargon, acts as a bridge with business leaders to optimize technology. Having over 25 years’ global experience (this includes working for RBC Royal Bank of Canada as Senior Project Manager for 5 years and Director / Program / Project Manager at CBK for 11 years, Payments System Consulting for 21 years).

Having verifiable track record in IT Project & Program Management (PMI, Prince2, AGILE/SCRUM), Application Development (Modular SDLC & PDLC), Architecture Technical Infrastructure and Business Process Re-engineering (ITIL, ISO, COBIT, SEI CMMI and ITSM). Steering Committee member for several projects. Skilled in bridging technical strategy and business priorities, delivering thought leadership, and facilitating high-stakes decisions. Experienced in promptly getting stalled/at risk initiatives off the ground and providing vision.

Recognized technical, and business process re-engineering expert with business expertise in Credit Risk & Market Risk, Basel II, Anti-money Laundering (AML), Retail Banking and Central Banking Practices, Regulations, and others.

Proficient in the successful implementation of multiple banking systems across global risk, payments and front office/back office environments, supported by world-class DW/BI architectures that was achieved by writing RFP’s / RIF’s, preparing detailed statement of work, obtaining approvals on budgetary proposals, evaluating vendor responses leading to vendor selection, Service Level Agreement (SLA) and contracting.

Hands-on in preparing business cases and presenting them to Senior Executives and board for budgetary approvals and change management using appropriate tools like Microsoft Visio diagrams, MS Project, Excel and PowerPoint. Fluent in English language and information sharing based on target audience.

Extensive expertise in PMO setup, managing project portfolio across multiple businesses, tactical deployment, promoting sustainable governance. Lead high impact strategic program initiatives with up to 125 project resources.

SIGNATURE STRENGTHS

- Project / Program Management of multi-million dollar enterprise and countrywide initiatives from inception to go-live.

- Integrated Team Management comprising of in-house, outsourced & off-shore teams

- Oversee teams comprising Subject Matter Experts (SME) like Solution Architects, Solution Designers Application Developers, Business Analysts, DBA, System Administrators, Project Managers, …etc.

- Budget and P&L Management across project portfolio.

- Stakeholder Management by effectively liaising, communicating and, building influential relationships with senior executives (Business and IT – CIO/VP/CTO) and board of directors.

- Enterprise Strategy Development from inception or updating existing strategies based on organizational vision.

- Solution Development and Continuous Process Improvement based on business goals.

- Technical Infrastructure & Operations Optimization

- Regulatory and Legal Compliance

- Contracts Negotiation and Closing, SLA creation and updates.

- Team Motivation and Executive Leadership

IT Expertise

- Enterprise Application Development & Product Development Life Cycle (PDLC)

- Process Engineering (BPM/BPR)

- Technical / IT Consulting

- System Architecture and Data Model Design

- Structured Application Development

- Code & Application Design Evaluation

- Disaster Recovery Management

- IT Change Management / Quality Control

- AGILE/SCRUM, PMI, Prince2, ITIL, ISO, SEI CMMI, COBIT and BPM Processes

LEADERSHIP SNAPSHOT:

- 25+ years of verifiable track record in IT Project & Program Management (AGILE, PMI, Prince2), Application Development, and Business Process Re-engineering (ITIL, ISO, SEI CMMI and ITSM).

- Led end-to-end implementation for one of the biggest CBK’s nationally important payment system – Kuwait’s Electronic Cheque Clearing System (KECCS a.k.a. ACCS).

- Expert in PMO setup, development, IT governance and management. Lead high impact initiatives with up to 100 project resources.

- Directed Global Markets Risk Management (GMRM) System ‘Real-Time’ Data-warehouse and Business Intelligence Reporting Project for RBC Royal Bank in Canada.

- PMO Nominee and Lead for establishing RBC Group Risk Management’s Basel II Program.

- Established cutting-edge application data warehouse and architectures for real-time business systems.

- Authored cheque truncation strategy (business and technical) with operational rules and regulations within State of Kuwait for CBK’s Executive Management.

- Steering Committee member for multiple projects within CBK.

Payment Systems Consulting and Program/Project Implementation Lead, Canada. Sept 2016 – Current

Engaged with Canada’s leading financial institution leading their implementation of multi-year Wires Modernization (including SWIFT MX ISO20020 readiness) projects as per Payments Canada’s Payment Modernization Roadmap.

The Central Bank of Kuwait (CBK), Kuwait. May 2005- Aug 2016

Director (Expert) – Business Process Re-Engineering (BPR), IT Strategic Planning Department

Director (Expert) – IT Projects, IT Strategic Planning Department – Project Office (PMO)

Project Manager, IT Strategic Planning Department – Project Office (PMO)

Promoted 2X to steer strategic planning, development, and management of entire BPR practice within CBK–– create, optimize, and implement business processes (BPM/BPM) and architecture initiatives, lead CBK’s PMO strategic projects, control operational and project budgets, oversee cross-functional team of consultants, stakeholders, and vendors, and design new workflows/processes for Banking Operations, Off-site Supervision (Regulating & Reporting), Human Resources, Administration, lead the ambitious Payments Systems modernization program.

Selected Accomplishments:

- Drove continuous improvements to overall bank operations by managing diversified portfolio of projects valued at $15M+, playing a vital role in process and technology design solutions that enabled CBK to scale service capabilities and operations.

- Drove the Payments Modernization Program leading to the successful implementation of the Kuwait’s Electronic Cheque Clearing System – an ambitious and strategic CBK goal to modernize the cheque clearing operations across the country which resulted in reduction of manual interbank clearing process errors, lowered operational risk and positioned Kuwait as the only GCC country providing same day access of funds to the depositors during the banks business hours.

- Boosted CBK’s IT help desk service delivery performance and user satisfaction by 75% through designing and implementing ITIL/ITSM/COBIT framework, application, and new business with governance processes, including ITIL training, SLA creation, and call center setup. Initiative led to IT help desk securing the ITIL certification in May 2016.

- Improved project ownership, quality, and governance by creating CBK PMO framework following best practices (PRINCE2 methodologies, PMI and quality assurance framework) and designing standard reporting tools and templates used by Executive management. Initiative led to CBK’s IT Sector securing ISO 9001:2015 certification in January 2016.

- Improved staff productivity by spearheading capability-enhancement training sessions focusing on project management and business process management.

- Reduced costs by identifying, selecting, and negotiating win-win, long-term rates with partnered vendors, built strategic relationships by establishing CBK’s RFP and procurement guidelines to ensure transparency.

Business Areas of Expertise:

Banking Operations, Off-site Supervision (Regulating & Reporting), Human Resources, Administration.

Selected Recent Projects Portfolio as the Director of BPR & PMO:

Senior Consultant & Senior Project Manager: CBK’s Cash Management System and Core Banking Implementation Program (March 2011 – Aug 2016 [UAT 2 stage]): – Managed solution architecture, interface design, established a resilient infrastructure for both these programs, created data migration and deployment strategy to migrate from legacy system to new core banking system. Established Testing Center of Excellence (COE) for the Core Banking Program.

►Few of the key external systems that CBS interfaces are AML, Automated Signature Verification System (ASVS), Bloomberg, CMS, FAME Data Warehouse, KECCS, Reuters, RTGS, SAS, SWIFT.

►Multiple Concurrent Roles: Senior Project Manager for delivery of Data Migration , Interfaces & System Integration, and Testing & Quality Assurance Projects. Senior Consultant to Executive Management on Technical & Solution Architecture, Business Process Re-engineering for Banking Operations & HR business units.

►Resources allocated to roles: ~75 resources including cross-technology & business teams and various vendor resources (on-site and off-site teams located in India, Jordan, Romania & UAE).

►Methodology used: Hybrid – Iterative/Rapid PMI PDLC with Agile.

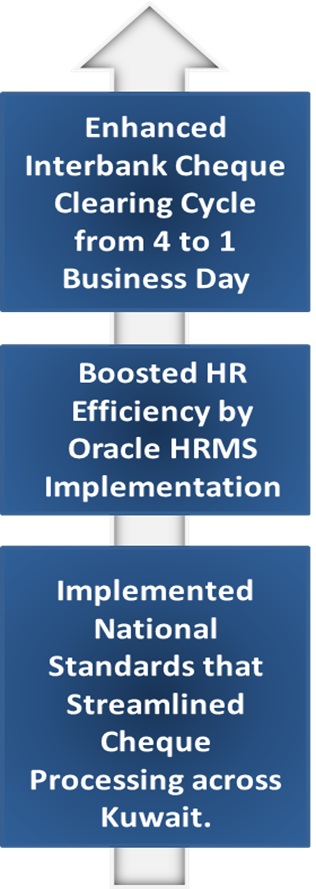

Program Delivery Manager & Steering Committee Member: Kuwait’s Electronic Cheque Clearing System (KECCS/ACCS) (Jan 2010 – June 2016): – Led end-to-end implementation of nation-wide cheque truncation system, setup of national cheques archive (allowing all banks to access their transactions with cheque images for a period of 15 years) for all cheques processed via KECCS, cheque standards, rules, regulations and governance structure to comply with set regulations while enhancing interbank cheque clearing cycle across the nation from 4 to 1 business day, in partnership with 23 Banks and CBK in its capacity as Kuwait’s National Clearing House covering 385 branches. KECCS processed 2.5M+ cheque presentments in its first year of operation (2015-16) with zero downtime as a direct result of its robustly established infrastructure and adherence to the KECCS Governance framework. Created Digital Media Strategy for KECCS.

►Few of the key external systems that KECCS interfaces are AML, ASVS, Core Banking Systems, RTGS & SWIFT.

►Multiple Concurrent Roles: Program Delivery Manager & Product Owner, Member of KECCS Steering Committee & Chair of KECCS Working Committees.

►Resources allocated to roles: ~125 resources including cross-technology & business teams, various vendor resources (on-site and off-site teams located in Hong Kong, Jordan, Romania & UK), and cross-functional teams from 23 local banks.

►Methodology used: Hybrid – Iterative/Rapid PMI PDLC with Agile.

Program Manager & Steering Committee Member: Human Resources Management System for HR Group (Nov 2007 – June 2014): – Enabled HR to Go-Live with new Oracle HR Management System (with real-time SMS notification and Employee Services Portal), cutting time-spent for payroll review by 50%, eliminating manual errors, reducing printing costs, and increasing HR satisfaction scores by 70% due to efficiency improvements.

►Multiple Concurrent Roles: Program Manager, Member of HRMS/HRIS Steering Committee.

►Resources allocated to roles: ~50 resources including cross-technology & business teams, various vendor resources (on-site and off-site teams located in Canada, India & UAE).

►Methodology used: Oracle’s AIM.

Senior Project Manager & Steering Committee Member: Cheque Process Modernization Program for Banking Operations Group. (Dec 2006 – Dec 2010): Steered implementation of establishing national standards that streamlined cheque processing across country. Implemented processing of CBK’s cheques electronically based on capture of cheques images and automated signature verification based on account operating rules for all CBK’s account holder (Government, Semi-governmental and other account holders regulated by CBK) in 2008.

►Role: Senior Project Manager, Member of CPM Steering Committee.

►Resources allocated to roles: ~25 resources including cross-technology & business teams, various vendor resources (on-site and off-site team located in India).

►Methodology used: PMI Iterative/Rapid PDLC.

Senior Project Manager: CBK’s IT Help Desk & IT Service Management System Program (June 2006 – May 2016): – Managed the end-to-end implementation of CBK’s Help Desk and established CBK requirements specific ITIL-ITSM framework. Ensured unwavering documentation of business/technical requirements to confirm alignment with scope. Created the RFP and successfully completed the vendor selection process for implementing the ITIL compliant help desk and service management application. Established COBIT based IT Governance framework that lead to better ownership and accountability within the IT Sector. Instrumental force behind development and establishment of SLA’s, escalation processes that lead to 75% increase in user satisfaction and up to 60% reduction in user downtime over a four year period. The IT help desk was successfully audited and awarded the ITIL certification in May 2016.

►Role: Senior Project Manager.

►Resources allocated to roles: ~25 resources including cross-technology & business teams, various vendor resources (on-site and off-site teams located in UAE).

►Methodology used: PMI Iterative/Rapid.

Program Manager: Off-Site Supervision Department’s Central Bank Reporting & AML Compliance Project for Traditional and Islamic Banks (June 2005 – June 2010): – Successfully completed by process re-engineering and leading the implementation of CBK’s reporting project for Traditional and Islamic banks to comply with Basel regulatory framework resulting from analytics utilized as inputs for compliance reporting to World Bank, International Monetary Fund (IMF) and time series data for State of Kuwait’s economic policy

►Roles: Initially as Senior Project Manager and later as Program Delivery Manager.

►Resources allocated to roles: ~25 resources including cross-technology & business teams, various vendor resources.

►Methodology used: PMI Iterative/Rapid SLDC.

Royal Bank of Canada (RBC), Toronto, Canada. Jan 2001- May 2005

Senior Project Manager, Global Markets Risk Management System (GMRM)

Directed full cycle project management of infrastructure/technology projects valued at $1M to $5M (CAD)––architecting, planning, research, selection and acquisition. Led production operations, infrastructure, test, and development environments, set release timelines, devised application solutions and enhancements, tracked and reported project progress, negotiated and managed vendors and contractors, and supervised 17-member cross-functional team. Supported pilot implementation of CMM based processes for RBC Project Office (PMO). Created disaster recovery and business resumption plans for systems and business units.

Selected Accomplishments:

- Lead the architecting of the GMRM application that processed 400K+ trading transactions and performed 300M+ computations overnight to independently re-assess market risk on proprietary trading portfolios across 4 major trading centers.

- GMRM’s deployment, helped business reduced capital reserve requirements of between $120M to $130M (CAD) as an outcome of leading the team to develop in-house risk assessment computation tool to ensure accurate and timely creation of Value At Risk (VAR) report––first in RBC’s technology history and considered leading-edge globally.

- Championed application development of real-time data warehouse and business intelligence reporting system.

- Contributed to $15M (CAD) annual net profit by steering system implementation upgrade that delivered regulatory relief of $100M+ (CAD) to RBC.

- Generated post-tax benefits worth $1M (CAD) through ensuring system eligibility for Scientific Research and Experimental Developmental (SR&ED) tax credit.

- Achieved zero disruption during systems transition from existing computing center to new large complex center.

- The GMRM project received 2003 Canadian Information Productivity Award (CIPA) under organizational transformation category in recognition for IT and innovation implementation excellence.

- Awarded with Royal Performance Award (2001, 2002, 2003, and 2004) for demonstrating professionalism and outstanding competency in helping Global Equities & Derivatives (GED) Operations in New York, U.S.A. after 9/11 tragedy.

- Pioneered implementation of 64-bit Windows Operation System and SQL 64 bit, in partnership with Microsoft and Intel.

- Collaborated with Gartner Research Group during bank-wide project benchmark study in an effort to compare project efficiency against similar projects completed globally; project excelled in most of categories.

- Designed and implemented disaster recovery and business resumption plans for the systems and business units.

- Managed subsequent enhancements to application, which included Single Risk Factor, Global Book, Specific Risk Phase 2, and Credit Derivatives Swaps (CDS) development projects, implementation resulted in additional savings of regulatory capital.

- Developed plan to move systems from existing computing center to a new large/complex center with resulting cut-over accomplished without disruption.

Project Manager, EC Cubed Canada Company, Toronto, Canada

Chief of E-Business – Projects, Silver Communications Pvt. Ltd., Pune, India

Turnkey Lead / Analyst, International Turnkey Systems (ITS), Kuwait

Co-Founder, PC Software Consultants & Gremlin Systems, Mumbai, India

Master of Business Administration (MBA) National Foundation for International Studies, Mumbai, India

Diploma in Computer Science

India International Trade Center (IITC), Mumbai, India

PMI Agile Certified Practitioner | Project Management Institute (PMI)

SAFe5 Certified Professional | SAFe

Business Process Management (BPM) Certified | Object Management Group (USA)

PRINCE2 Project Management / IT Governance / IT Security / Portfolio & Program Management | IBS/Lifelong, Kuwait

ITIL Foundation Certification Course | Lifelong, Kuwait

Project Management Institute (PMI) – USA, 2000 – ongoingProject Management Institute (PMI) – Southern Ontario Chapter, Canada, 2000 – ongoingProject Management Institute (PMI) – Arabian Chapter, 2005 -2016Project Management Institute (PMI) – Information Systems Special Interest Group, 2000 – ongoingInstitute of Electrical & Electronics Engineers (IEEE) – USA, 2000 – 2016International Swaps and Derivatives Association Inc., 2001 – 2005Working Group Participant, FpML (Financial products Markup Language) Architecture, 2001 – 2004

Business Process Management (BPM) Group, 2005 – ongoing

ISACA, 2016 – ongoing